News & Blog

CIL3: The Dominance of the Stock of Houses on Price

Posted onFebruary 14, 2013

or,

“If I had a pound £ for every time I heard a commentator referring to planning and the supply of land for new housing as being the sole cause of high house prices in the UK…..

….I’d be a very rich man”.

You often hear Government Ministers and industry commentators talking in the media about the affordability of housing in the same breathe as the supply of new housing.

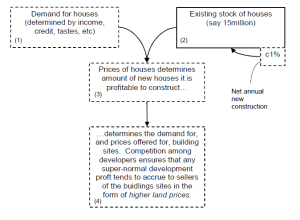

Of course, simple supply and demand theories, as in the previous blog, would suggest that if you increase supply of houses the price should be reduced ceteris paribus. However, this is rather simplistic given the dominance of the ‘stock’ of existing houses over the ‘flow’ of new houses into the market.

Notwithstanding there may be a premium for a new house, house-builders do have to advertise and sell their houses in the context of the market that already exists in the surroundings – i.e. the stock of existing second hand properties that are on the market. So if the average price of a 3 bed town house is £150,000, this will limit the price that a developer can attain for similar new properties.

The tone of residential sales prices in a market area therefore caps the development value of a scheme. These prices inform the value paid for land derived by residual appraisal. Hence it is not solely the supply and price of land that is driving house prices. This was acknowledged in the Barker Review (March 2004).

The Barker Review was about meeting the ‘challenge of creating a more flexible housing market’ and ‘delivering an adequate supply of housing’. It was an important report in the context laying the foundations for infrastructure funding. The Planning Gain Supplement (PGS) was born out of the Barker Review and this was superseded at the end of the last parliament by CIL.

Barker did acknowledge the dominance of stock of houses on price. Barker said (p18),

1.26 There are factors other than supply that contribute to house price volatility:

– demand for housing and housing space is sensitive to changes in income, however, demand is less responsive to price. As a consequence demand will only fall off if house prices rise significantly; – mortgage finance which is reliant chiefly on short term interest rates; and – speculation and expectations play an important role in the housing market, expectations of future

1.27 The supply of housing is not the main factor driving house price volatility and indeed some level of volatility is inevitable owing to the inherent time lags involved in new construction. New housing supply may also have a limited effect on prices in the short term. Prices tend to be determined by the stock of houses. In any one year new houses only account for 10 per cent of transactions and add 1 per cent to the stock. In the short run, therefore, prices will inevitably be determined chiefly by demand.

This effect is illustrated on the following diagram (figure 1) from Jack Harvey’s book, Urban Land Economics.

Figure 1

The balloon of cheap ‘sub-prime’ mortgage finance prior to the credit crunch is well documented. With hindsight, the main factor driving house prices up during the last boom was not just the supply and cost of land, but the demand for housing; driven by the availability of cheap mortgage finance. It was much easier for buyers at all levels of the market, but particularly first time buyers, to get affordable mortgages with minimal equity and this fuelled demand.

This is important to remember when setting CIL rates. CIL adds to the costs of a development and therefore does have the potential to negatively impact the supply of housing. However, as we have learned above, price and affordability is driven chiefly by demand which is not effected by CIL (which is a supply side issue).

The next blog will pick up some more themes from the Barker Review which are still relevant today for CIL.